How can building owners and operators plan ahead to satiate the stipulations in the Climate Mobilization Act and Local Law 97 (LL97)? Make no mistake, the CMA is a carbon tax. This is the first point we all must consider. Any strategy based on avoiding all the CMA’s penalties (aka taxes) may not be realistic, or even advisable.

Finding the Optimal Economic Balance for LL97

Let’s look at CMA and LL97 as a CFO would, which would be to run their business at the lowest net cost. When it comes to CMA, the ingredients include investments, penalties, and annual costs and savings. So, the question becomes simple: What is the optimal economic balance?

Here’s a simple example:

You have a 200,000 sq. ft office building that performs at 100 Energy Use Intensity (EUI) in 2020 – all-electric. Your 2030 target EUI is 64. Having ignored the temperature complaints from your occupants, by 2028 you’ve achieved an EUI of 65! At this point, your summer and winter space temperature setpoints are 80˚F and 60˚F respectively, you don’t run your HVAC unless you must, and you have all the latest equipment, tech, and controls in place.

Will you invest in energy reduction projects to avoid the remaining penalty? Before you can say yes, you’ll probably want to know what it is worth… In today’s dollars, that avoided penalty is about $4,500, and the electric savings approximately $7,000 – a total benefit of $11,500. Now, will you invest? If you are like me, you now want to know the cost of the energy project so you can calculate your return on investment.

To understand the cost, you will need to know the investment required to get an annual savings equivalent of $11,500 in 2028, at which time you feel you’ve exhausted every opportunity for energy savings in your facility. There is only one thing to say about that – it is either significantly more expensive than getting those equivalent savings today, or it is totally free – you’ll just turn off the A/C altogether.

The example is intended to illustrate the concept of an inflection point in the savings curve. At some point, it becomes advantageous to pay the CMA fine rather than invest in further energy reduction. See Figure 1 below.

Figure 1

There are many considerations you must account for when onboarding the CMA into your organization’s financial and energy CMA Playbook. Since the future is unknown and crystal balls are in short supply, you would be well-positioned to create a dynamic plan that can illustrate the business case to your board and be updated when more facts come to light or progress is made – a playbook.

Considerations for CMA Planning

A playbook will speak to the actions you plan to take, goals you set to achieve, and metrics that measure your success. What the playbook doesn’t do is speak to the economics behind it. For that, an analysis of the economics must be completed and should provide at least the following economic views:

- Your CAPEX and Operational energy investment cash flow for the next 10 to 20 years

- Your annual energy use and savings through 2030

- Your post-investment CMA penalties from 2024 through 2030

- The economic hurdle rates of all future energy projects and initiatives

To get these economics correct, a deep technical understanding of your building(s) is required as is extensive experience in energy projects and control systems. Below are some of the drivers behind the economic cash flow projects of a robust CMA Plan.

The size of your facility drives the paybacks of energy projects

When you have more scale and repetition in your energy-consuming building systems, you will generally have lower paybacks. For example, a 10,000-ton central chilled water plant costs about the same to optimize as a 2,000-ton plant. If any of your air handlers are identical in configuration, the roll-out of energy projects gets economies of scale rather than becoming individual science projects. Size, capacity, and diversity are all influencers on payback.

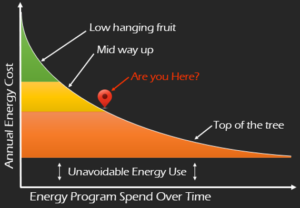

As you reduce energy consumption, reduction gets more costly

The more you invest in energy savings, the less attractive the investments get. If your facility is currently brimming with low hanging fruit, you may consider tacking on some of the less attractive initiatives to these early-stage projects to bring their paybacks closer to your economic thresholds, effectively leveling your future-project economic forecasts.

Your current EUI has a lot to do with the project economics you can expect

If you have a brand-new building with a higher EUI, you probably have several low-payback, low-cost opportunities – possibly controls focused – ready to implement. If you have an older facility that hasn’t been upgraded, you may have low-payback, higher-cost opportunities – such as capital improvements – ready to be developed. On the other hand, a lower EUI in both a newer or older building changes that payback landscape, making the payback highly susceptible to local circumstances. Your EUI should be considered when negotiating your acceptable economic criteria for energy projects.

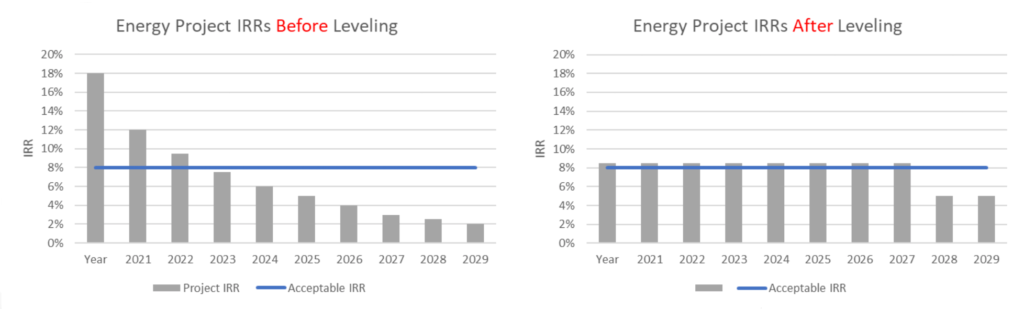

Simple payback is dead

The advantages of simple payback are that it is easy to comprehend and compare and it doesn’t have a lot of room to cheat. Unfortunately, CMA makes simple payback obsolete. With penalties increasing in steps, economics change annually and thus invalidate the use of simple payback. Investment Rate of Return (IRR) or similar metrics must be used to quantify the return on investment for energy projects.

You will need a budget

To address any of the CMA energy reduction requirements, you will need a budget. Hopefully, this article sheds some light on how that budget can be developed without knowing the projects you will be implementing. For more information and to discuss the details of your project, contact our team today.